Fishing Charter Pricing Strategies That Maximize Profit

Fishing charter pricing is not just about covering fuel and bait. It is a strategic lever that determines profitability, booking consistency, customer perception, and long-term business sustainability. The most profitable charter operators treat pricing as a dynamic system shaped by demand, operating costs, customer psychology, and competitive positioning rather than a static number copied from competitors.

Table of Contents

- Understanding the Economics of Fishing Charters

- Calculating True Operating Costs

- Common Charter Pricing Models

- Demand-Based and Seasonal Pricing

- Value-Based Pricing and Customer Perception

- Upsells, Add-Ons, and Revenue Stacking

- Discounting Without Destroying Margins

- Competitive Analysis Without Price Wars

- Using Technology to Optimize Pricing

- Pricing Mistakes That Kill Profitability

- Top 5 Frequently Asked Questions

- Final Thoughts

- Resources

Understanding the Economics of Fishing Charters

Fishing charters operate in a high-cost, low-margin environment. Boats depreciate quickly, fuel prices fluctuate, and weather introduces unavoidable volatility. Profitability depends less on volume and more on optimizing revenue per trip while controlling fixed and variable costs. According to marine business studies, operators who actively adjust pricing based on demand and cost inputs outperform flat-rate competitors by as much as 25 percent annually.

Calculating True Operating Costs

Many charter captains underprice because they underestimate real costs. True operating costs include fuel, bait, ice, maintenance, dockage, insurance, permits, licenses, loan payments, marketing, booking software, accounting, and crew compensation. Long-term costs such as engine overhauls and electronics replacement must be amortized per trip. Without a precise cost-per-trip baseline, any pricing strategy is guesswork.

Common Charter Pricing Models

The most common models include half-day and full-day flat rates, hourly pricing, per-person pricing, and specialty trip pricing. Flat-rate trips simplify sales and appeal to private groups. Per-person pricing works best for shared or party boats. Specialty pricing for offshore, night fishing, or tournament prep trips captures higher willingness to pay. The most profitable operators often combine multiple models rather than relying on one.

Demand-Based and Seasonal Pricing

Demand fluctuates by season, weather patterns, fish migrations, tourism cycles, and local events. Peak-season weekends should never be priced the same as slow midweek trips. Dynamic pricing allows operators to raise rates during high demand and offer controlled incentives during low demand. Airlines and hotels have proven this model maximizes revenue without reducing bookings when implemented correctly.

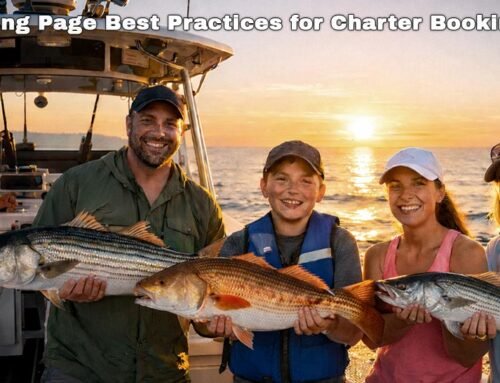

Value-Based Pricing and Customer Perception

Customers do not buy hours on a boat; they buy experiences, expertise, and outcomes. Professional branding, modern equipment, safety standards, customer reviews, and captain reputation all increase perceived value. Value-based pricing aligns rates with what customers believe the experience is worth rather than what competitors charge. This approach supports premium pricing without relying on discounts.

Upsells, Add-Ons, and Revenue Stacking

Base trip pricing should not be the only revenue source. Profitable charters layer revenue through fish cleaning, premium tackle, photography packages, extended trip time, destination upgrades, and private instruction. Even modest add-ons can increase revenue per trip by 10 to 30 percent with minimal added cost, significantly improving margins.

Discounting Without Destroying Margins

Uncontrolled discounting trains customers to wait for deals and erodes brand value. Strategic discounts should be limited to off-peak times, last-minute availability, locals-only promotions, or bundled packages. Offering added value instead of price reductions protects margins while still incentivizing bookings.

Competitive Analysis Without Price Wars

Competitive pricing should inform boundaries, not dictate strategy. Price wars lead to lower profitability for all operators and often degrade service quality. Instead of matching the lowest price, successful charters differentiate through expertise, targeting specific customer segments such as families, corporate groups, or hardcore anglers willing to pay more for results.

Using Technology to Optimize Pricing

Booking platforms, CRM systems, and analytics tools allow operators to track booking patterns, customer behavior, conversion rates, and seasonal demand. Data-driven pricing decisions replace intuition with measurable insights. Operators who adopt technology-driven pricing report higher utilization rates and better revenue forecasting.

Pricing Mistakes That Kill Profitability

The most common mistakes include copying competitor prices, ignoring rising costs, underpricing peak demand, failing to upsell, and not reviewing pricing annually. Pricing should evolve as fuel prices, regulations, customer expectations, and market conditions change. Static pricing in a dynamic market guarantees shrinking margins over time.

Top 5 Frequently Asked Questions

Final Thoughts

Fishing charter profitability is driven by intelligent pricing, not luck or volume. Operators who understand their costs, align pricing with perceived value, adapt to demand, and leverage upsells consistently outperform those who rely on flat rates or competitor matching. Pricing is a strategic discipline that must evolve alongside market conditions, customer expectations, and operational realities. When treated as a system rather than a number, pricing becomes the strongest profit driver in a fishing charter business.

Resources

- NOAA Fisheries – Commercial and Recreational Fishing Economics

- U.S. Small Business Administration – Pricing Strategies Guide

- Marine Industry Association – Charter Business Cost Analysis

- Harvard Business Review – Dynamic Pricing Models